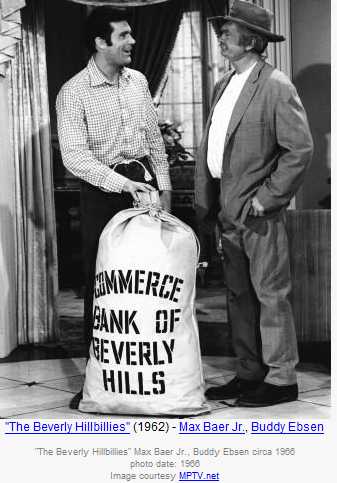

Although the major news media both print and electronic have ceased to beat the drums for answers to fraud/embezzlement in the 1031 Exchange industry, many consumers remain interested in finding answers to the question: When will it be completely safe to invest your life savings with a Qualified Intermediary performing a 1031 exchange? Will we always feel like “Jed Clampett” dealing with “Milburn Drysdale”? Will the Donald McGhans and Ed Okuns of the world always walk away unscathed?

Like many people who have commented here in the past, a new voice has popped up with what appears to be sage advice. The following is a comment received today from “Jay.” Jay’s comments were in regards to my article: — Southwest Exchange: “Uh, Uhm. . . uh. . .” $100,000,000 Reasons to Perform Due Diligence on Your 1031 Exchange Company

Read it and give us feedback about how you feel about this vital matter:

- I’m not an attorney, but I’ve read a lot about 1031 exchanges. Alexandra is correct about the “constructive receipt of funds” issue. The IRS rules prohibit the taxpayer from having control of the funds, actual or constructive, during the exchange period. Starker may have received interest, but remember that Starker was a pioneer in the process. After Starker’s case and until the IRS published rules for deferred 1031 exchanges (as I recall around 1990, give or take a year), most attorneys and CPA’s recommended to their clients that they avoid receiving interest because of the constructive receipt of funds issue. This position changed with the publication of the rules which included clarification that the taxpayer could receive interest on funds held by a Qualified Intermediary. I think that Rob also makes a good point that people should consider both the QI’s fee and interest policy when calculating the true cost of the QI’s services. Congress’s position on 1031’s in general is that because of “like-kind” substitution, the nature of the investment does not change, only the security for that investment. Therefore, a taxable event has not occurred. That being said, it would really simplify things if Congress and the IRS would relax the “receipt of funds” prohibition like they do in some other section of the Internal Revenue Code. Until that happens (which might be never), look for company ownership and financial strength in picking a QI as has been suggested by others above.Comment by Jay — October 8, 2007 @ 10:49 pm |

Please let us know how you feel: Like a Jed Clampett, a Ed Okun, or a Milburn Drysdale?

The statement that taxpayers should avoid receiving interest is complete wrong.

There has NEVER been any risk that a taxpayer receiving interest could cause constructive receipt of the funds.

That line is used only by unscrupulous QI’s who want to greedily keep all of the interest on the funds they hold.

T.J.Starker received a growth factor on the exchange obligation of Crown Zellerbach and the very first regs promulgated by Treasury allowed the same concept.

Most competent attorneys and CPAs advice theuir clients to make sure they DO recieve the intertest on the funds held and shop for a safe QI that will pay them the highest interest rate.

Please do not be misled by unsound advice to the contrary.

As to the IRS relaxing that concept, I still predict that it is unlikely that they will do so.

I would favor a scheme similar to the old IRC §1034 personal residence “roll over”, but I doubt the IRS will ever go that far.

There are structures used by QIs such as mine, where the taxpayers consent is required to move any of that taxpayer’s funds.

That protections is far superior to any bond or insurance since at best, those can only provide repayment of funds lost or taken, whereas our structure effe3ctively prevents the funds from ever being moved so they can never be “lost” in the first place.

If you have any questions, please feel free to e-mail me directly at egenolf@egenolf.com or visit our website amherst1031.com

Rob,

I can count on you for solid information. Do you run a 1031 seminar or consumer related seminar? If not have you considered pitching this to the Marin County Chambers of Commerce around the county?

Dean

Actually I have given seminars on 1031 throughout the country for years.

Many many years ago, I formed one of the very first QIs associated with a national title company and spent nearly two years of my life giving seminars to clients and title personnel from New York to California and Florida to Montana.

I have a favorite cousin Will and his wife Lexie who live in Marin and would love to come to town and give a seminar there someday.

Rob,

Just by the virtue of your longevity, you could be considered a pioneer in this industry. What is the single biggest change in your experience that has helped and or hurt consumers in regards to 1031 exchange transactions?

I love to see you in Marin giving a seminar. Consider that you will have at least one fan showing up for the event. . .

Dean

is accountant who recommended that client place his funds into OrKun’s 1031 company liable for negligence for not conductiung a due diligence investigation of the Orkun company?